Industry analysts are a critical part of any B2B market place, especially technology. They should therefore be an important consideration in every B2B marketing campaign. While their influence on your business may not always be obvious, it makes sense to at least consider what that influence might be and how best to make it is positive.

Types of analyst

Broadly speaking, they can be categorised as two main types of organisation – those that focus on the size, shape and growth of markets, and those that focus on the performance, functionality and capability of individual products and vendors.

DC – Irish Markets infographic

The best know organisation focused on market trends and sizing is perhaps IDC, though some sectors might have their own dominant player (such as Smithers Pira

Smithers Prira – 3D Print for Industrial Applications event

in the print industries). These organisations are vital to help you understand which areas of your market place offer the greatest opportunity and therefore to indicate how you might best adjust your overall strategy to address them.

Likewise, the biggest player focused amongst the functionally focused analysts is Gartner. Again, there are others that have a greater impact on specific markets (such as Ovum in broadcast technology). These organisations can help you to understand how well your product fulfils market demand at a functional level, and also if you have ‘pitched’ your product to address the way customers see the requirement. Importantly, these ‘functional’ analysts are also most likely to be called upon by customers to recommend products that are available for specific requirements.

Regional variations

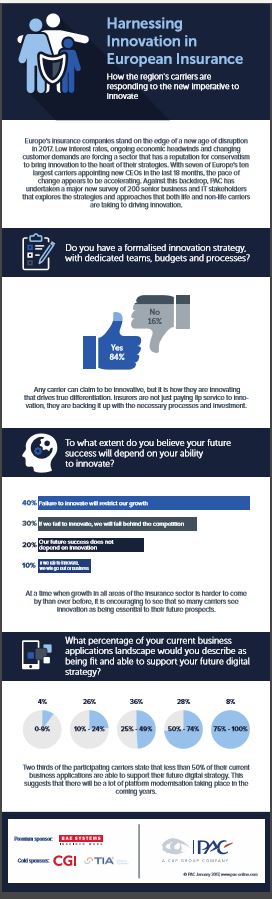

US organisations and technology companies from just about everywhere else will be well aware of the big US-owned analyst firms (IDC, Gartner, Forrester, Frost & Sullivan), but there are also some regional variations to be aware of. For example, the CXP group (and it’s Pierre Audoin Consultants sub-brand) almost ‘owns’ the French speaking market, and in Germany, many businesses defer to the university network to perform an analyst function. There are many other national and regional specialists such as Diginomica that deliver specialist client-side or vendor-side services as well, and they can have a surprisingly high vertical or geographic penetration and you will even find that some countries favour one US analyst brand over another.

In addition, individual industry analysts exist in a global talent market. An analyst living in Manchester and working for Gartner does not automatically focus on providing services in the UK. He/she may well be a global specialist in a vertical application, such as business intelligence software or mechanical CAD.

Frost & Sullivan – methodology

Know your industry analysts

It’s not too hard to build up a picture of the analyst firms, or even the individual analysts who work in your market segment – it just requires a bit of diligent research. However, finding out who they are is only the first point. You then absolutely need to read what they say. While much of this is wrapped into expensive reports, most firms encourage their analysts to blog extensively, and much of the material promoted here is available (at least in part) for free.

Pierre Audin Consulting – Insurance industry – trend report & infographic

It’s also a valuable investment to take opportunities to hear what analysts have to say in person at events and in presentations. My experience is that they are usually very accessible at these events and often enjoy being challenged on their points or asked to explain related issues – a great way to start building a relationship.

Rules of engagement

Rule 1 – Analysts must always be neutral

Never do anything to try to ‘buy’ an analyst’s opinion because as soon as anyone believes that opinion has been bought then it is worthless. The value to you and to every reader and user of their output comes from an analyst’s neutrality. You might not always like everything they say about you, but you really do have to accept it and either put-up with it or act upon it.

Rule 2 – Don’t waste their time

Analysts are by their nature highly qualified, highly experienced, and therefore highly paid. They also have incredibly high targets set for them on saleable outputs and chargeable engagement.

Know who they are, what they specialise in and what you can say to them that they will value. If you want to talk to them but otherwise ignore Rule 2, take your cheque book with you.

Rule 3 – They aren’t journalists

Don’t treat analysts the same way as you do journalists. They do different things and they work in different ways.

Where as you should never expect a journalist to keep quiet about something you tell them, you can pretty much guarantee that an analyst will – or at least they’ll keep it anonymous.

Don’t expect an analyst to ‘deliver coverage’ because that’s not what earns them a crust. Instead they gather the information you give them and assimilate it with the hundreds of other items of information that your competitors and customers, their competitors and their colleagues, are also telling them, and they will then form an opinion. This opinion, based on accrued evidence, will probably appear months later in their planned reports – or if you’re lucky, in a private recommendation to a new prospect of yours.

Forrester Research – methodology

Rule 4 – Make them feel special

There is no point in doing all the research to establish their specialities and individual interests if you then try to put them all in the same room and give them an identical briefing.

True enough, if you’re a big player then you can probably run an ‘analyst day’ event. But even the 800 pound gorilla in your market needs to throw each analyst a custom-grown banana or two so they have something ‘unique’ to work with.

To carry the targets most analysts have requires a big ego – you better be prepared to feed it on occasion.

Rule 5 – Respond to information requests

Analysts who see you in the market place might well contact you for product information or opinions. If you want to feature in their reports, thinking and recommendations then you better make sure you are able to to provide the information they ask for. As a priority too, because if you’re on the list for the first time then you’re probably only one of several possible new entrants to the report.

Gartner – Top strategic predictions for 2017 and beyond – report

Rule 6 – Pay for paid-for services

Analysts are great sources of information on you to your customers. But if you want to know what your customers think about the market or about you then be prepared to work with analysts. They may want information and opinion or else contacts from you, but if you want detailed research or in-depth opinion you’ll need to pay.

Bloor Research – Foundation issues for the Chief Data Officer – report

Likewise, a very legitimate way of drawing an analysts attention to your product is to pay them to review it. Many, such as Gartner, won’t publish anything though others (for example Bloor Research) might. What they will do is give you a 3rd-Party view on how your product meets the functional requirements of the market, and how they see the way you position your products fitting into the market opportunity.

What you then need to do is to respond to their advice with changes to your product roadmap and marketing. Do this and (amazingly) you’ll see your product start to improve in their reports and rankings.

Diginomica – report

Rule 7 – Keep doing it

Industry analysts are there for the long-term and your relationships to them should reflect this. ‘Industry analyst relations’ is not a hit-and-run activity. If you want to get good, long-term reporting and recommendations then you need to keep up your relationships with your key analysts.

Analysts programmes can therefore represent a substantial marketing investment over a considerable period of time. You therefore need to plan carefully how you deploy your available resources and ensure you target the most influential analysts in your market (see Rule 2) to get the best results from your campaign.

Rule 8 – Exploit shamelessly (but with care)

If an analyst says something good about you USE IT, especially if you are also paying for consulting services from that analyst company. But always do so in a way that does not infringe their carefully selected copyright. They will all advise you on this. Some activities will cost you extra money, some will be free, and some you’ll find that you’ve actually already paid for.

Analyst relations is a form of PR, and the whole essence of PR is after all to encourage 3rd-Parties to talk positively about you. In the B2B world, Industry Analysts probably offer the best source of 3rd-Party endorsement any organisation could wish for.

We have plenty of experience working on Industry Analyst Relations for US, UK and Japanese companies. If you’d like to talk to us about helping with your IAR programme in Europe or the UK, call us.